Recession in the Ann Arbor Area Housing Market?

Are There Signs of a Real Estate Slowdown as of August 2022?

“I’ve heard there’s going to be a recession. I’ve decided not to participate.”

What is a Housing Recession?

According to a recent article by Madeline Garfinkle in Entrepreneur Magazine entitled “Homebuilder Confidence Drops for 8th Consecutive Month, U.S. in Housing Recession,” she states there was a 6 point drop in August 2022 in the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) making the index negative.

What is the Home Market Index based on?

1. Current sales of single family homes.

2. Prediction of single-family home sales for the next 6 month.

3. Traffic of perspective buyers.

According to the article, the index has not been negative since 2020 at the start of the pandemic.

What could be contributing to this negative housing news?

What is Happening Nationally in Economic News?

Pretty much every measure of economic health is negative right now.

Two quarters of declining Gross Domestic Product or GDP. The official definition of an economic recession.

S&P 500 Index year-to-date -17.2%

Gold value year-to-date is -5.79%

Bitcoin value year-to-date -57.35%

Inflation rate year-to-date as of July 2022 is +8.5%

National average price for a gallon of gas is $3.84 compared to $3.18 a year ago.

Rent is up as much as 17% in some places since last year.

Mortgage rates average 5.55% for a 30 year mortgage compared to 2.86% last year.

So how does all of this negative economic news affect the housing market in the Ann Arbor area?

“Pretty much every measure of economic health is negative right now.”

What’s Happening Locally in The Ann Arbor Area Housing Market?

With all this negative economic news and negative housing sentiment, you would think there would be a recession in real estate in the Ann Arbor area.

Let’s take a look at the data.

1. Median Sales Price Trend Through August 2022

Source-Ann Arbor Area Board of Realtors

The median sales price for the entire Ann Arbor area MLS was up 9.3% year-to-date in August.

The median sales price has only been on an upward trend since 2019.

No sign of a price correction as of August 2022.

2. Percent of List Price Received with Offer

Source-Ann Arbor Area Board of Realtors

As you can see in this chart, the percent of asking price received since 2021 has been over asking price more than 100% of the time on average.

No sign of a housing slow down in the Ann Arbor area.

3. New Listings Through August 2022

Source-Ann Arbor Area Board of Realtors

The available inventory of homes for sale has only gone down and even more rapidly recently.

More listings would help reduce upward price pressure but with many people having locked in low interest rate mortgages this will be a challenge.

According to the website Marketplace as of July 2022, the U.S. was short of available housing to rent and own by 3.8 million homes adding to the lack of housing inventory.

And with home builder sentiment dropping, construction labor shortages and material cost and supply chain issues, the number of new houses and apartments being built will likely continue to not meet demand.

Still no evidence of a housing market recession in Ann Arbor area real estate.

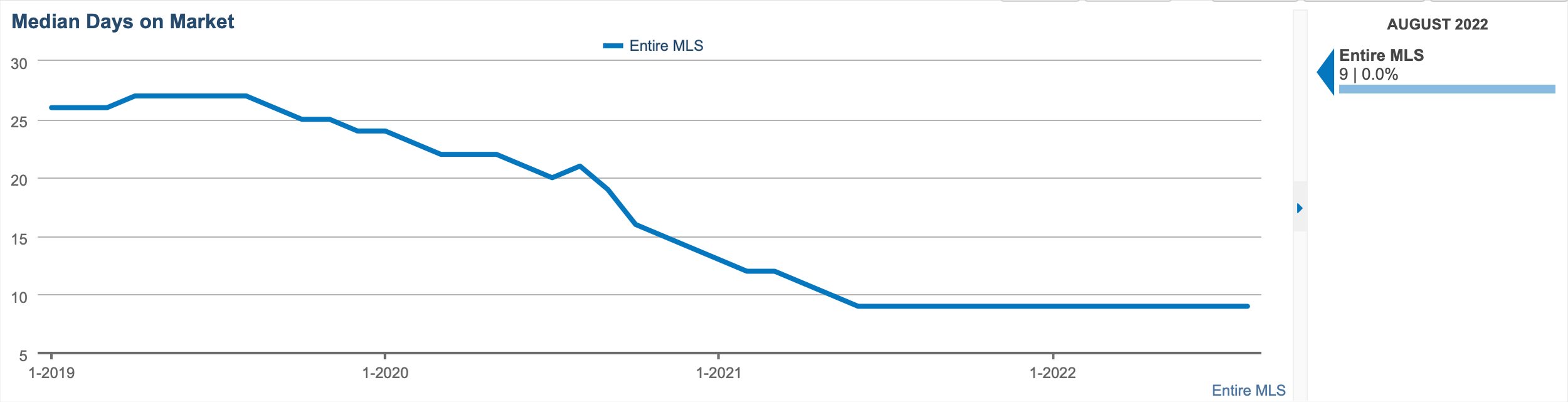

4. Median Days on Market as of August 2022

Source-Ann Arbor Area Board of Realtors

For the entire Ann Arbor area MLS, the median days on market has averaged about 9 days on market before selling since the middle of 2021 and shows no sign of changing.

No sign of a slowdown in real estate sales.

How Can a Real Estate Professional Help You Navigate this Market?

Having a team of professionals that follows the real estate market and keeps you informed and positioned best as a buyer, seller and investor will protect your interests and generate exceptional results.

Buyers- Buyers in this market need to be pre-qualified and prepared to move quickly on an opportunity as they don’t last long. Buyers may have more negotiating power in this market because of all the perceived economic negativity.

Sellers- Sellers still hold a strong negotiating position in this market as there are few properties on the market and a housing shortage compared to demand.

Investors- Investors will do well in this market, or any market, as long as they focus on cashflow. If the cashflow of the property is positive, it doesn’t matter what the interest rates are or the future value of the property although appreciation and adding value are always goals as well. Cashflow is king and it is always the right time to invest in a cash flowing real estate.

Let the experienced team at Arbor Advising hep you buy, sell and invest.

So, Is Real Estate in the Ann Arbor Area Experiencing a Slowdown as of August 2022?

The short answer is no.

The median sales price continues to climb.

In fact, offers received still tend to be over asking price.

New listings and available properties to buy continue to go down.

Finally, the days on market until sold remains low at an average of 9 days.

All of the data for the Ann Arbor area real estate market show no sign of slowing much less a recession.

To your success!

Arbor Advising has a passion for helping people buy, sell and invest in real estate. We believe real estate is the best way to create passive income, grow your wealth and provide inflation adjusted returns in retirement with fantastic tax benefits.

Want to learn more? Contact us.

Disclaimer:

Always speak to your CPA, investment advisor and attorney before making any investment decisions. Past performance does not guarantee future returns. Arbor Advising seeks to educate and does not endorse any specific product, service or investment.